Integration Overview

Learn about the integration methods that connect your CRM with FlexPay’s payment recovery solution

To recover failed payments with FlexPay, your CRM must first be integrated with our platform. FlexPay offers two primary integration methods to accommodate diverse business needs. The API integration method includes options such as Enterprise Integration, Enterprise with Scheduler, and Recovery Advisor, enabling seamless, automated connections for real-time payment recovery. The batch file integration method, Quick Start Recovery, is an excellent option for getting started quickly, supporting proof-of-concept initiatives, or serving as a temporary solution while API integration is being implemented.

This guide outlines each integration method, helping you choose the approach that best aligns with your technical capabilities and recovery objectives.

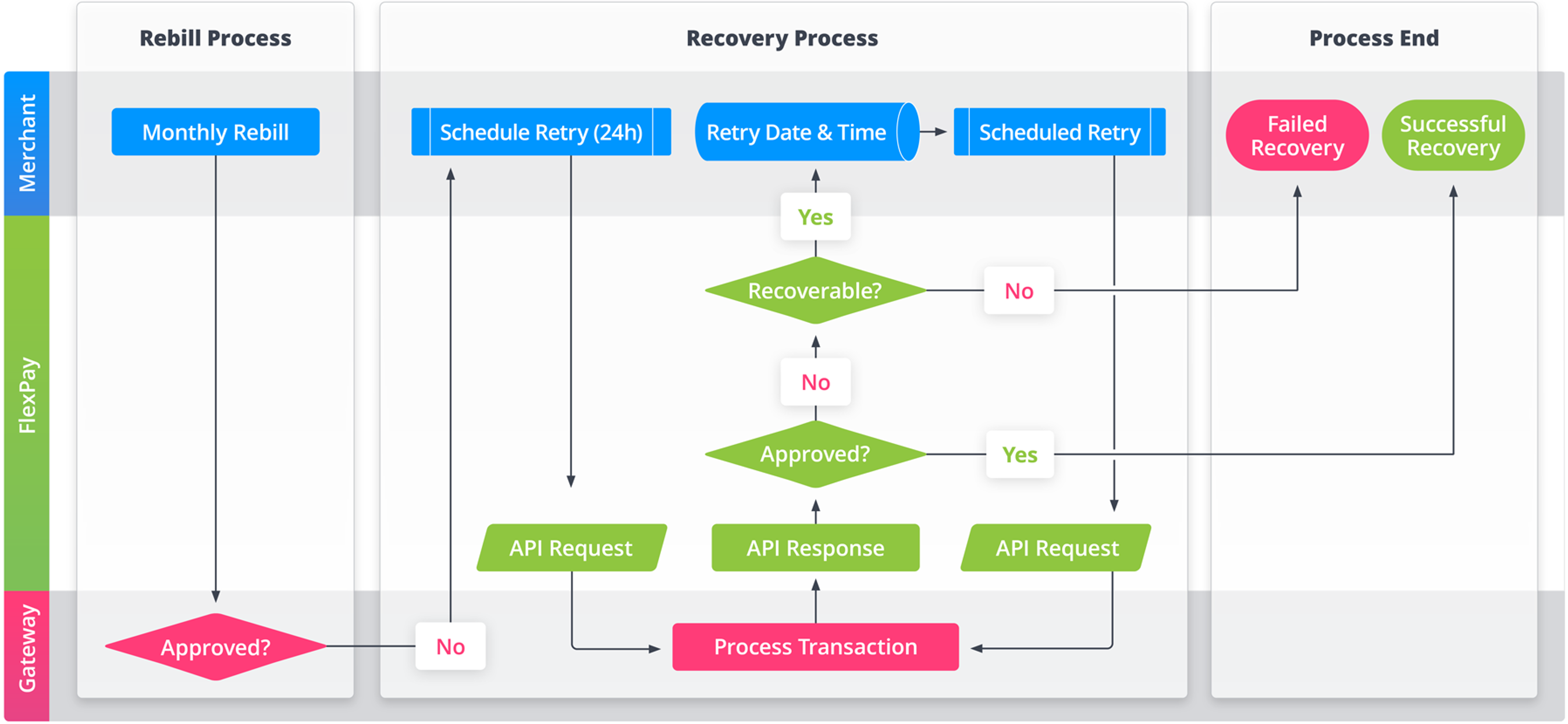

Enterprise Integration

In this payment recovery method, FlexPay functions as an invisible intermediary between your system of record and the payment gateway. When a retry attempt is initiated, it is routed through FlexPay to your native gateway. We analyze both your request and the gateway’s response, returning an enhanced response payload in real-time. If the transaction is declined again, our response will include a recommended Retry Date & Time. FlexPay continues to process each subsequent rebill attempt until the transaction is either approved, hard declined, or determined by our AI to be unrecoverable.

Step-by-Step process

- A merchant attempts to rebill a customer, but the transaction is declined by the gateway.

- The merchant schedules to process the retry through FlexPay's API the next day.

- FlexPay reviews the transaction details and performs any data cleanup if it determines it will increase the likelihood of success. The transaction is sent directly from FlexPay to the Gateway.

- FlexPay receives the response from the Gateway.

- If the transaction was not approved and the recovery engine determines the transaction is recoverable, it sends a response back with the best date and time to retry the transaction.

- The merchant schedules the transaction and retries on the date and time provided by FlexPay.

- The transaction is resubmitted through FlexPay.

The process continues until there is a successful recovery, a hard decline, or FlexPay no longer considers the transaction recoverable.

For details on how to integrate, please see the Enterprise Integration guide

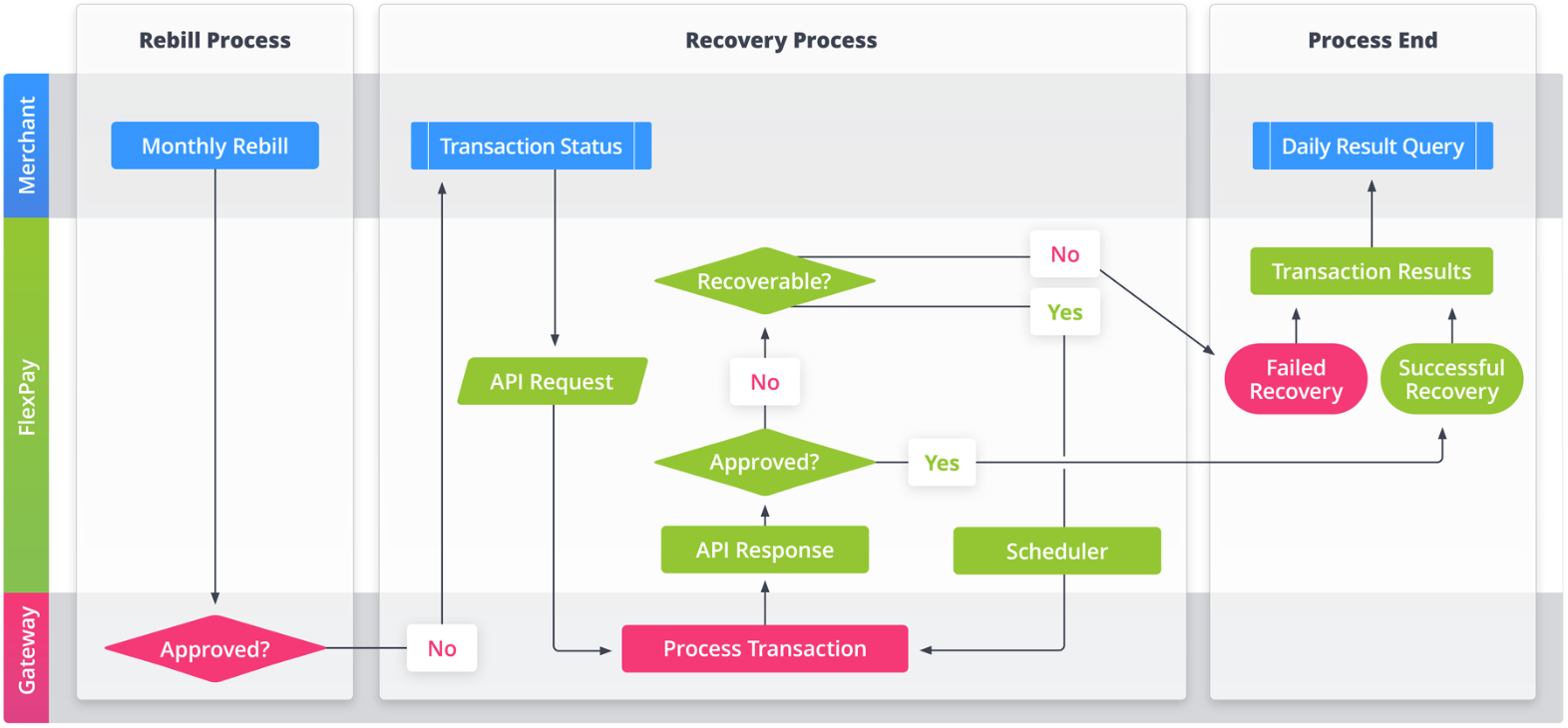

Enterprise with Scheduler Integration

In this integration method, retry attempts are routed through FlexPay to your payment gateway. Similar to the standard Enterprise Integration, we analyze your request along with the gateway’s original response, generating and transmitting an enhanced payload. If a transaction is declined again, FlexPay evaluates the response and automatically schedules a new retry attempt on a future date, optimized by our recovery engine for the highest likelihood of approval. This scheduling and retry process continues, leveraging insights from our machine learning models, until the payment is either approved, hard declined, or deemed unrecoverable.

Step-by-Step process

- A merchant attempts to rebill a customer, but the transaction is declined by the gateway.

- The merchant sends details about the declined transaction to FlexPay, along with the decline code and decline message from the Gateway.

- FlexPay reviews the transaction details and performs any data cleanup if it determines it will increase the likelihood of success. The transaction is sent directly from FlexPay to the Gateway.

- FlexPay receives the response from the Gateway.

- If the transaction was not approved and the AI machine-learning engine determines the transaction is recoverable, it schedules the transaction to be retried on a future date.

- When the scheduled date arrives, FlexPay will send the transaction to the gateway for processing.

- The process continues until there is a successful recovery, a hard decline, or FlexPay no longer considers the transaction recoverable.

- The merchant will query FlexPay daily to obtain an up-to-date status of their transactions.

For details on how to integrate, please see the Enterprise with Scheduler Integration guide

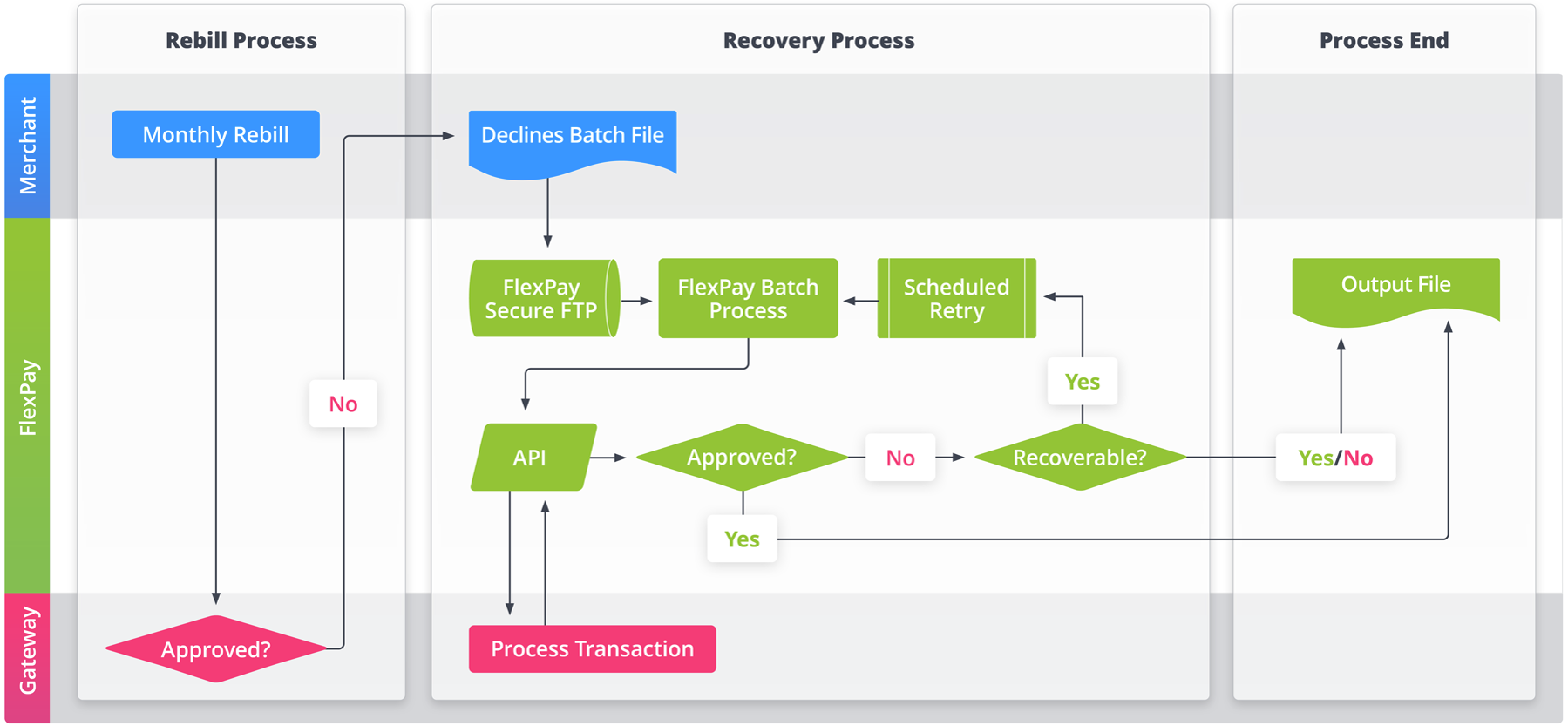

Quick Start Recovery

This integration method allows you to recover declined transactions by connecting to FlexPay’s servers via SFTP and uploading flat files with the relevant transaction data to a designated folder. FlexPay processes each transaction in the file, analyzing the data to determine the optimal retry date. We handle all communication with the payment gateway for each reattempt and provide a daily output file containing the results of the recovery process.

Step-by-Step process

- A merchant selects a cohort of failed payments to be treated by FlexPay. This can be a set period of failed payments from the past (for example the past 30 days), or newly failed transactions for a given day (ie, the failed payments from today's processing).

- The merchant generates a file with the failed transactions and uploads it to FlexPay's SFTP.

- FlexPay reviews each transaction in the file and performs any data cleanup if it determines it will increase the likelihood of success. The transaction is sent directly from FlexPay to the Gateway.

- FlexPay receives the response from the Gateway.

- If the transaction was not approved and the AI machine-learning engine determines the transaction is recoverable, it schedules the transaction to be retried on a future date.

- When the scheduled date arrives, FlexPay will send the transaction to the gateway for processing.

- The process continues until there is a successful recovery, a hard decline, or FlexPay no longer considers the transaction recoverable.

- FlexPay provides an output file every day at 15:00 UTC with the Payment Results of the transactions processed the previous day. Alternatively, you can generate a Payment export from FlexPay's Client Portal.

For details on how to integrate, please see the Quick Start Recovery Integration guide

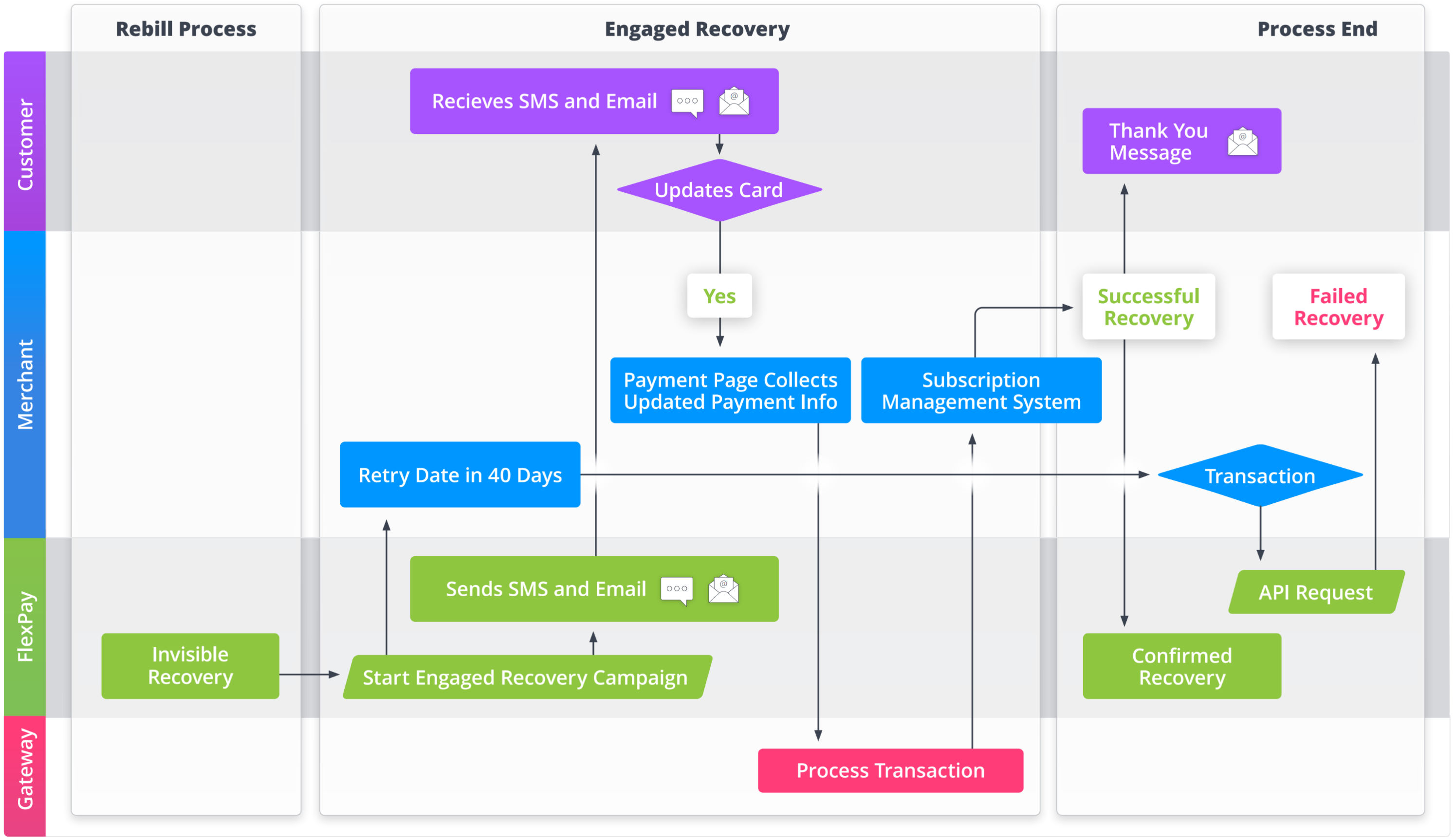

Engaged Recovery

The Engaged Recovery integration method is an ideal complement to Invisible Recovery efforts. Once FlexPay's machine learning models determine that a payment is unlikely to be recovered, an Engaged Recovery outreach campaign is initiated. This campaign leverages the principles of behavioral science to maximize the chances of payment recovery. Through a series of carefully crafted messages delivered via email and/or SMS, Engage Recovery aims to elicit emotionally positive responses from customers.

Step-by-Step process

- When Invisible Recovery determines a payment is unrecoverable, the Engage Recovery (ER) campaign is triggered. A retry date, typically 40 days later (depending on configuration), is provided to the CRM along with the response.

- The ER campaign initiates with automated email and SMS outreach to the customer.

- The customer follows the instructions in the outreach messages to update their payment information in the CRM.

- The CRM processes the payment directly through the gateway and updates the subscription status.

- The CRM notifies FlexPay of the successful recovery.

- FlexPay updates the transaction record and closes the outreach campaign.

- A final message is sent to the customer, thanking them for their payment.

- If the payment information is not updated throughout the campaign, the CRM retries the payment according to the schedule provided in Step 1.

- FlexPay's response confirms that the recovery campaign was unsuccessful.

For details on how to integrate, please see the Engaged Recovery Integration guide

Updated 26 days ago