Overview

FlexPay is a failed payment recovery solution that uses AI-driven machine learning and behavioral science to reduce the impact credit card declines have on revenue and retention.

How does it work?

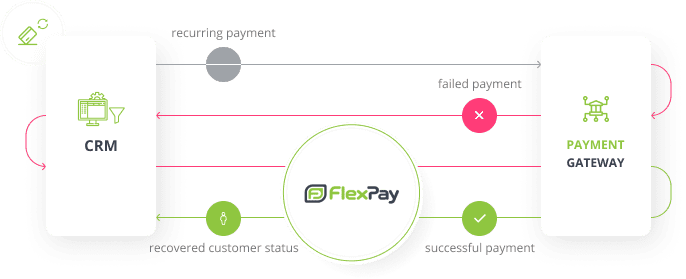

FlexPay plugs into any CRM and payment gateway to coordinate AI-powered strategies that recover failed payments from recurring transactions, such as subscriptions or installments.

FlexPay’s platform selects the best method to recover each failed payment, delivering the highest subscriber recovery and retention rates. The result is a significant reduction in your involuntary churn, and more revenue from recovered customers.

AI-powered Invisible Recovery™ works directly with the payments system to recover most failed payments quickly without the customer ever knowing their payment was declined. It analyzes the data sent with each transaction and determines the best time, transit route, and testing process to maximize your approval ratio.

For failed payments requiring customer involvement, Engaged Recovery™ applies behavioral science to persuade customers to promptly resolve the problem and keep their subscription active.

We combine powerful technology with high-touch support and guidance from payment industry experts to help merchants achieve maximum performance, given their specific business context and payment stack.

Transactions are sent from your sales tool (CRM) into FlexPay. If the initial transaction is a soft decline (a response received from the issuing bank upon sending a transaction approval request whereby the payment cannot be processed temporarily), the FlexPay internal algorithm will analyze the data sent and derive the next best date, time, and gateway on which to process this transaction to obtain an approval. For transactions that cannot be recovered through the payment system (especially hard declines), the client is contacted.

How long does it take to add FlexPay to my systems?

The duration of an integration project depends on what CRM or billing system you are using. If you’re using a CRM we’re already integrated

with – such as Stripe or Chargify — we can configure your account in just a few hours.

If you are using a custom CRM or another unique setup on systems of record, integrating with our API typically takes between 10-30 days to complete.

We’re already integrated with the most popular gateways and can add new gateways in as little as three days.

How does FlexPay increase my revenue?

To understand how FlexPay can increase your business revenue, it is important to grasp why so many of your transactions are failing and how these failures can be significantly reduced, leading to increased revenue thanks to FlexPay.

According to a study by Visa, in-person/card present transactions fail 1.5% of the time; eCommerce transactions fail 15% of the time; and recurring transactions fail 24% of the time. This last number is so high because the fraud detection systems banks use are very sensitive and often make mistakes. The bank errs on the side of caution and flags a transaction as fraudulent even though it is legitimate. While this is inconvenient for the merchant and the customer, the bank would rather block a true transaction than risk letting a fraudulent one get through.

Since a subscription payment is submitted by the merchant as a card-not-present transaction, the customer isn’t right in front of the seller to provide another payment method if their transaction isn’t approved. This failed payment can be lost forever unless the business has a failed payment recovery strategy.

FlexPay combines over four decades of payments industry experience with an expert data science team to continuously improve our current modeling algorithms. These data scientists leverage the latest technologies to create new Machine Learning models and regularly upgrade our existing models to optimally improve recovery rates.

Our Machine Learning solution draws from a rich amount of data equaling 7% of all US annual transactions. This data gives our AI and Machine Learning solution deep knowledge about the specific decline codes, types of cards, MCC behavior, and changes based on geography that are needed to optimize the recovery strategy for each failed payment.

Other companies may offer a failed payment recovery solution as one of their many product offerings, but FlexPay is 100% dedicated to solving the failed payment problem and reducing involuntary churn to zero. We are constantly improving our Machine Learning models and innovating our solution to ensure we always deliver optimal results.

Updated over 1 year ago